The coronavirus pandemic has battered high-yield municipal bonds likely to be stung by the deep economic slowdown. But it’s improving the outlook for one segment of the market: debt backed by the settlement payments that states receive from tobacco companies.

That’s because the size of the annual payouts are pegged to sales of cigarettes — and consumers stuck idly at home don’t seem to be cutting back much.

Whether it’s low gas prices, expanded unemployment benefits or bulk purchases by people sheltering in place, cigarette shipments have declined only 1.8% this year, according to Management Science Associates Inc., an analytics firm that tracks retail sales. That’s a far smaller drop than the 4% to 6% previously forecast by the tobacco company Altria Group Inc.

Advertisement

Bans on flavored electronic cigarettes may also be buoying traditional cigarette sales, said Mikhail Foux, the head of municipal strategy at Barclays.

“Anecdotally, there’s a consumption increase,” Foux said. “People are sitting home and really have nothing to do.”

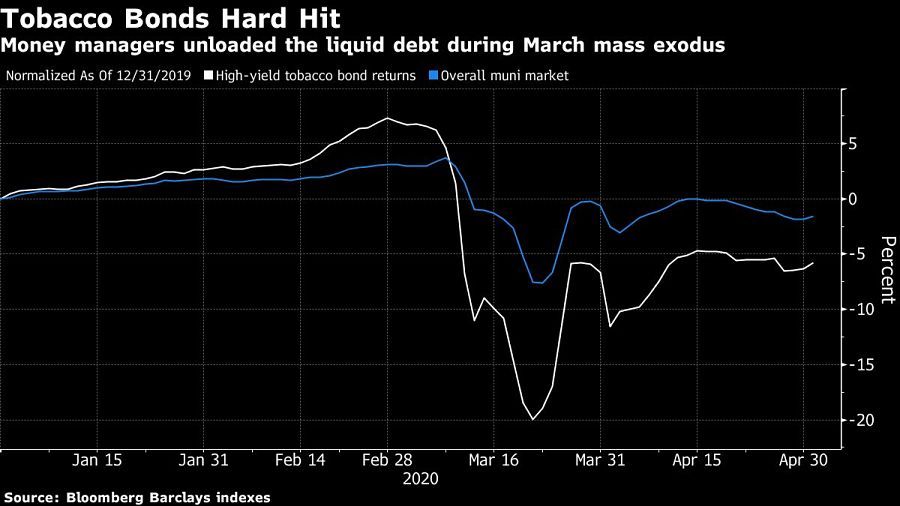

Municipal bonds repaid with revenue from a 1998 settlement with major tobacco companies were crushed during the muni market’s record sell-off in March, when investors pulled $40 billion from mutual funds in two weeks. High-yield funds sold their most liquid bonds — like the heavily traded tobacco debt — to raise needed cash, driving the securities to a 13% loss in March, according to Bloomberg Barclays Indexes. They’ve since rebounded along with the broader market.

Ohio’s Buckeye Tobacco Settlement Financing Authority bonds due in 2055, which dropped to about 73 cents on the dollar in March after being issued in February at 109 cents, have rallied back to 93 cents.

Municipal tobacco bond prices may also benefit from corporate bond investors looking for an escape from the woes of the energy industry, which dominates the high-yield corporate market, Vikram Rai, a strategist at Citigroup Inc., said in a call with clients Monday.

“We expect tobacco will get some tailwind from this phenomenon,” he said.

[More: Muni bond market already seeing first wave of distress]