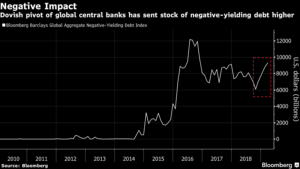

Last October, the world’s stock of negative-yielding debt had tumbled by more than half from its record high as investors adjusted to the end of super-loose monetary policy. Now it’s soaring again after the dovish pivots around the world.

The Bloomberg Barclays Global Aggregate Negative-Yielding Debt Index has increased in value by well over $3 trillion since its low five months back, to $9.3 trillion Wednesday. That’s still below the all-time record of $12.2 trillion in June 2016.

Advertisement

As warnings over the global growth outlook abound, bond yields have been in retreat. One risk-free benchmark — 10-year Treasury yields — are close to their lowest level in about a year. Japan’s equivalent is back in negative territory, while that on German Bunds is teetering on the brink, at about six basis points above zero. Even in Australia, which hasn’t seen a recession since the 1990s, 10-year yields are now below 2%.

“The bond market is correctly adjusting that growth is going to be slower in developed markets next year,” said Andrew Sheets, chief cross-asset strategist at Morgan Stanley.

Central banks are adjusting, too. The Federal Reserve has put rate hikes on hold and signaled it may phase out the run-off of its bond portfolio by year-end. The European Central Bank has put off plans for its first rate increase since that region’s debt crisis. The Reserve Bank of Australia has abandoned guidance that its next move will definitely be a rate rise.