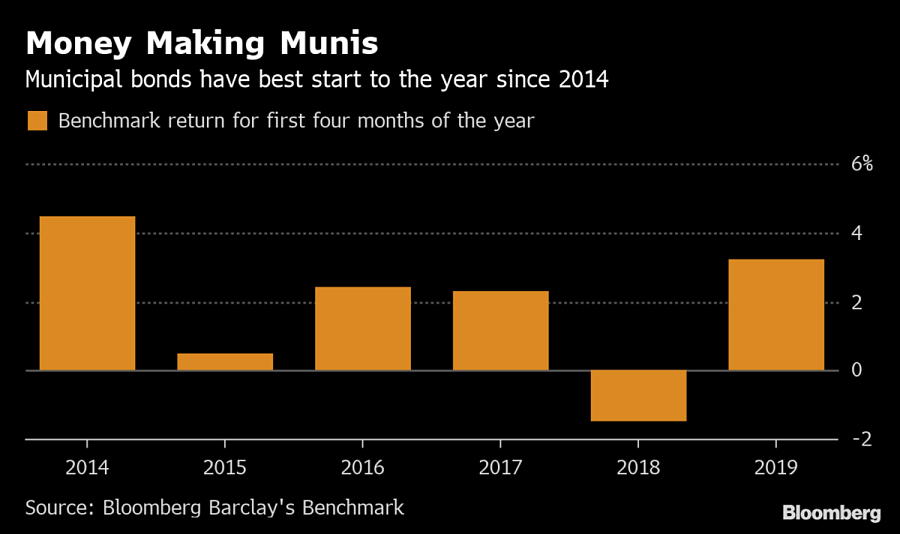

Municipal bonds are off to their best start in five years.

The Bloomberg Barclay’s benchmark state and local government debt index has returned 3.2% since the beginning of January, the most for the first four months of the year since 2014. The securities have been bolstered by low supply and seemingly unbounded demand, with almost $4 billion flowing into municipal mutual funds in April alone as investors scrambled for tax-exempt debt to offset the federal cap on state and local tax deductions.

Advertisement

“A lot of this is really stemming from the fact that people came to the realization that buying in-state bonds was the best way to go,” said Debra Crovicz, a managing director at Chilton Trust Co.

Though municipal debt is underperforming investment-grade corporate bonds, which pay higher yields because the securities are subject to state and federal income taxes, munis have returned more than double Treasury securities since the start of the year.

That was helped by the relatively weak pace of borrowing in April, when state and local governments issued about $24.6 billion in new bonds. That’s down 16% from last year, according to data compiled by Bloomberg.

“With low issuance in April — offset with a huge amount of money coming into bond funds — the market will do extremely well in terms of total rate of returns,” Ms. Crovicz said. “Unless we see an increase in Treasury rates, we will remain right around these levels in the near term.”