Unless a once-in-a-decade reversal hits, investors are about to book once-in-a-decade returns.

Virtually everything is winning in this remarkable year, and the world’s major asset classes are collectively on course for the strongest annual performance since 2009. Even in a go-slow week, the S&P 500 posted four record closes.

“We call it a grand cru, which in wine terms means a very good vintage,” said Dirk Thiels, the Brussels-based head of investment management at KBC Asset Management.

Advertisement

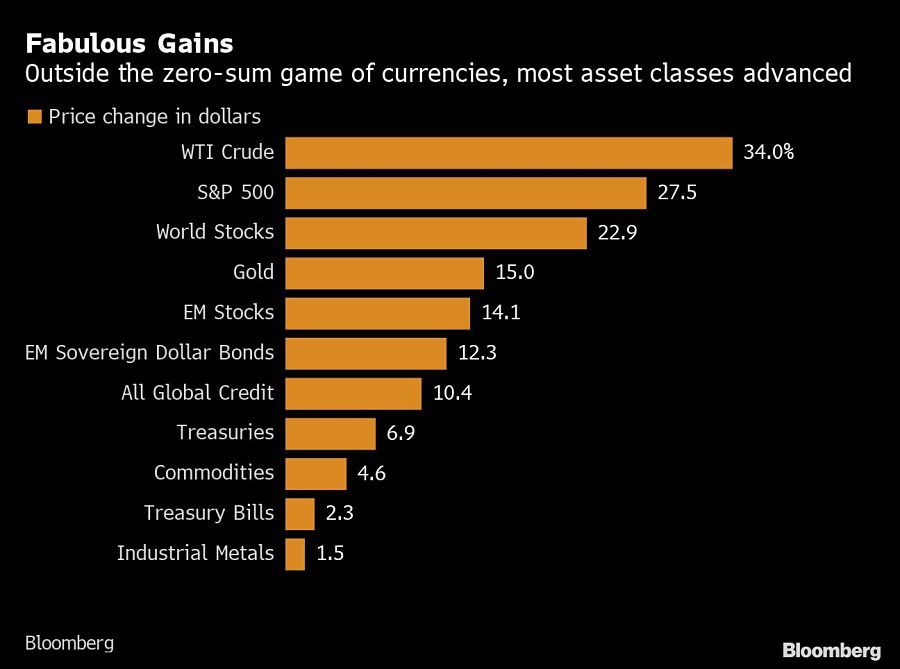

The scorecard tells the story: America’s equity benchmark has climbed 28%. A global stocks gauge is up 23%. A worldwide credit index rose 10%. Emerging-market sovereign dollar bonds added 12%. Even Treasuries and gold, those classic safe havens, advanced about 7% and 15%, respectively. Staying on the sidelines was about the only way to lose — the greenback has gone nowhere in 12 months.

Yet even as they pop corks in celebration, traders mapping out their 2020 strategies know the scoreboard only tells half of the story. This brilliant year has brutal roots, and it’s blurring the outlook for anyone making a call on what lies ahead.

“A lot of what we’ve seen at the beginning of the year was actually taking back some of the correction in the last part of last year,” Mr. Thiels said.

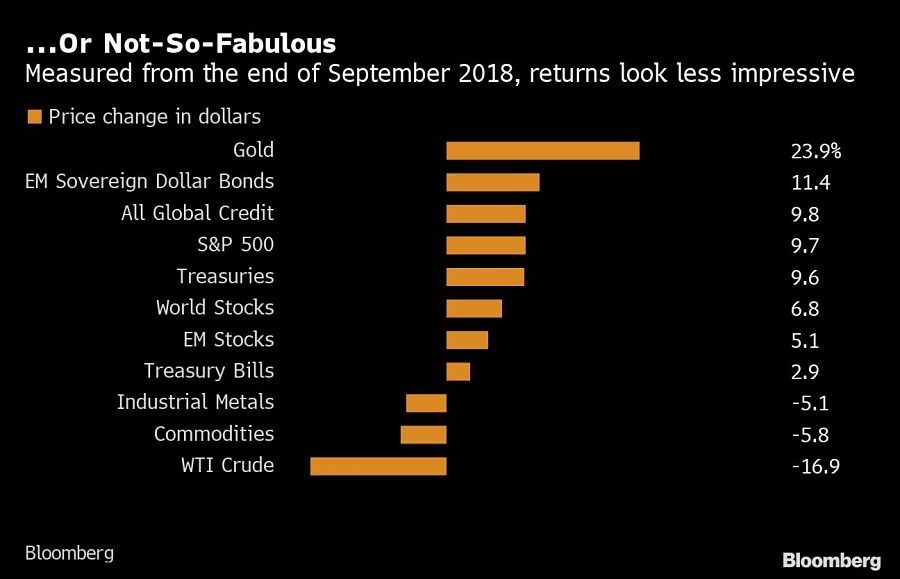

The fourth quarter of 2018 was the setback that allowed the comeback. Put aside the tendency to think in calendar years and consider some of the returns since the end of last September: The S&P 500 is up about 10%. Global stocks climbed less than 7%. Adding those extra three months to the calculation means 50% bigger gains for Treasuries and gold.

The trick of the light is that the market reversal came with a pivot by major central banks toward easier policy, which coincided with the calendar. In December 2018 the Federal Reserve was still raising interest rates; by January the hiking cycle had ended.

“Equities became relatively attractive again while interest rates went down,” said Simon Wiersma, investment manager at ING Bank’s wealth management unit. “We have to be honest: it was a far better year than we expected.”

The dazzling gains are almost blinding for Wall Street’s prognosticators. For instance, with the S&P 500 already well above many year-end expectations, professional forecasters are giving the least optimistic annual outlook in more than a decade.

“Our core argument at this point will be that there’s a lot of good news priced in,” said David Holohan, head of equity strategy at Mediolanum. “It leads to what is probably a sideways move from here just by virtue of how much more expensive equities have gotten.”

Bond yields will be a similar story, he said, unless a big shift in macro data prompts any move by the Fed.

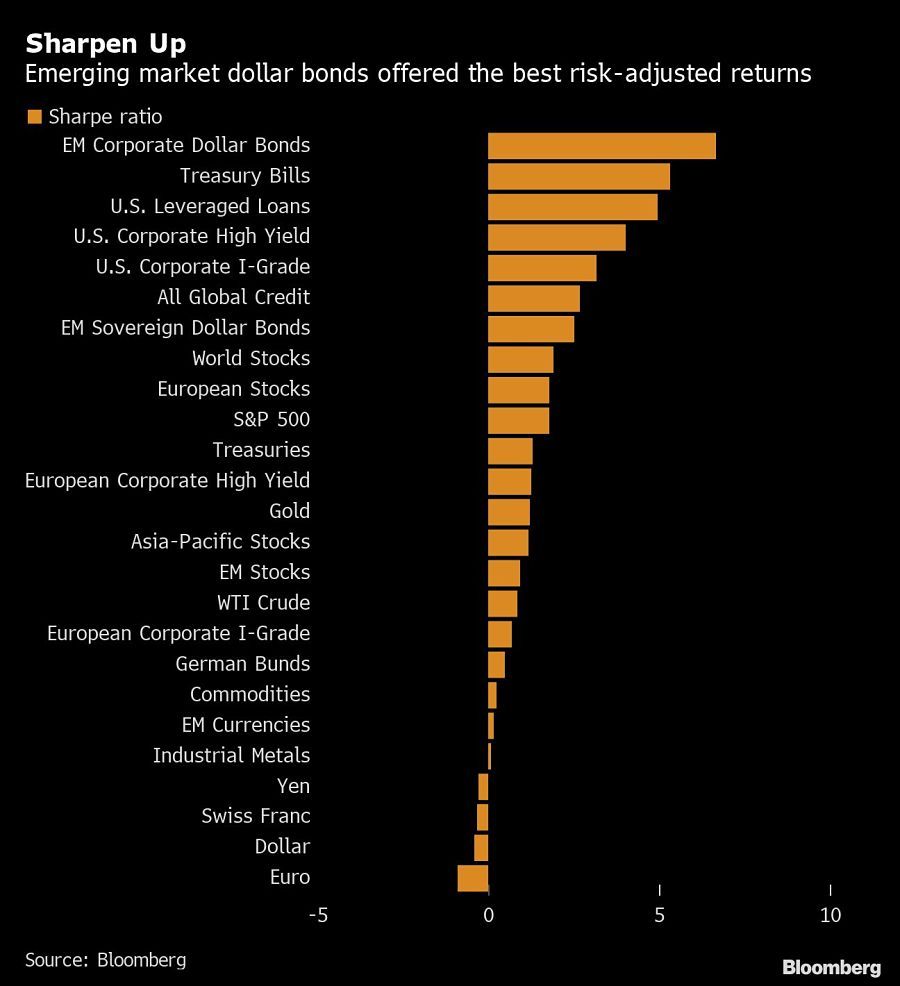

Elsewhere, the strong performance of investment-grade credit and emerging-market bonds is broadly similar whether you include the 2018 turmoil or not, which underscores the stocks-led nature of that rout. Adjusting for the volatility of each asset in 2019, gauges of corporate and developing-nation debt are also among the best-returning.

Thank demand for duration amid stubbornly low inflation, enduring — albeit slow — economic growth, and an era of negative rates that makes it easier for borrowers to service their debts while sending investors in search of assets with a reasonable yield.

Even allowing for those types of structural market shifts and the rebound which the 2018 fourth-quarter tumult made possible, the performance across assets this year surpassed many expectations.

“We would have envisaged a good year in terms of performance by virtue of how bad December was last year,” Mr. Holohan said. “However, the sheer magnitude of the increase, particularly what we’ve seen in the last quarter, is certainly ahead of expectations.”