As recession fears swirl, investors are chasing defensive strategies that won big in the crisis. But a quant at a $335 billion firm says it may be a recipe for disaster.

A slew of safe stocks could prove anything but this time round — they’re already crowded and expensive, warned Eugene Barbaneagra. That’s why the manager at SEI Investments Co. is snubbing a popular strategy tracked by systematic funds — quality equities — that now have diminished capacity to outperform.

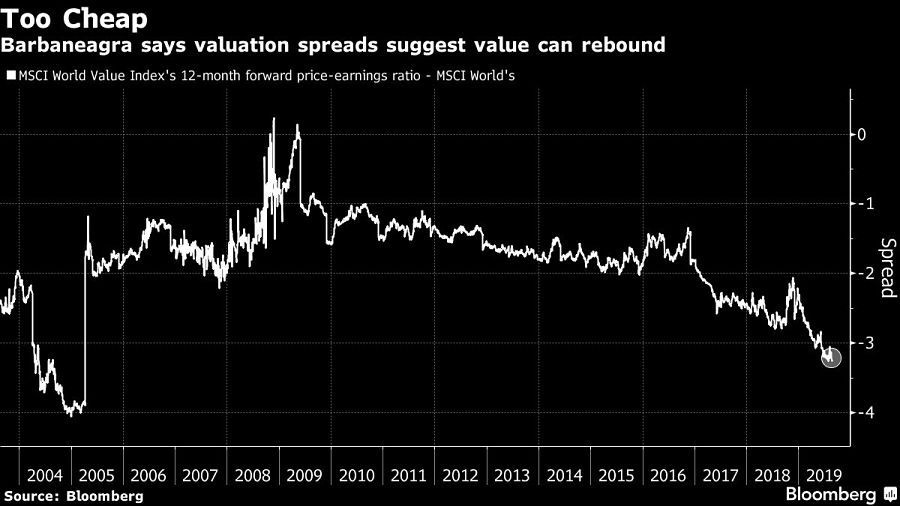

On the flip side, Mr. Barbaneagra is placing a contrarian wager that shunned value stocks may have found a floor.

Advertisement

“If the crisis were to repeat, there is a difference,” said Mr. Barbaneagra, who oversees equities and portfolios with third-party mandates. “The premium for quality is unlikely to go higher up because it’s just not worth it.”

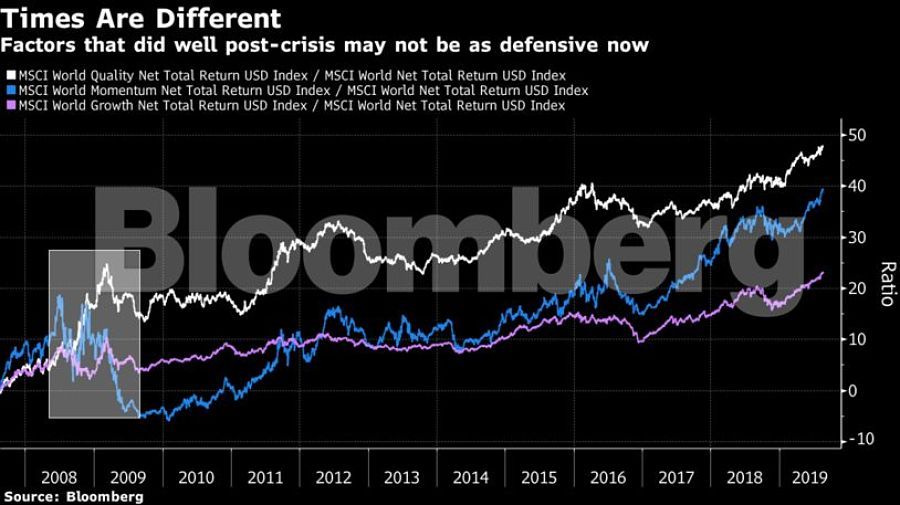

Recession fears have helped ramp up the performance of defensive styles like quality to near records versus the overall market, MSCI indexes show. The same goes for price-momentum strategies given their protective tilt right now. Relative premiums for value shares that are more sensitive to the growth cycle have plunged to near 15-year lows.

All that has widened the schism between winners and losers this month to a level unseen in a decade, Evercore ISI said on Monday after calculating the dispersion of returns across factors.

It suggests that a slew of investing styles dubbed ports in a storm will struggle to live up to their label if a recession takes hold, though Mr. Barbaneagra is not expecting another global crisis.

U.S.-listed exchange-traded funds tracking quality factors from low leverage to steady profits have attracted $3.7 billion this year — on track to be the biggest on record for the strategy.

In one of the hottest debates in quantland, the SEI Investments manager departs from the likes of AQR Capital Management, which is skeptical about timing factors based on relative valuations.

“Performance-chasing leads that fund manager to buy more and more of the same stocks for the same characteristics — ultimately that makes the underlying factor very expensive,” the London-based investor.

That’s also the case with price momentum right now, which buys the past year’s winners like defensive stocks and dumps losers like value, he said. Defensive styles still have capacity to outperform over the long haul, he added.

The Pennsylvania-based firm has a mix of quantitative and discretionary allocation styles.

The SEI veteran reckons cheap shares could hold their own even if the growth outlook darkens, a departure from the conventional wisdom that the group’s fortunes will only be revived if animal spirits return.

“Cheap stocks are cheap because they carry some sort of a risk but they’re much, much cheaper than expensive stocks — that would imply that that risk is well-priced,” he said.

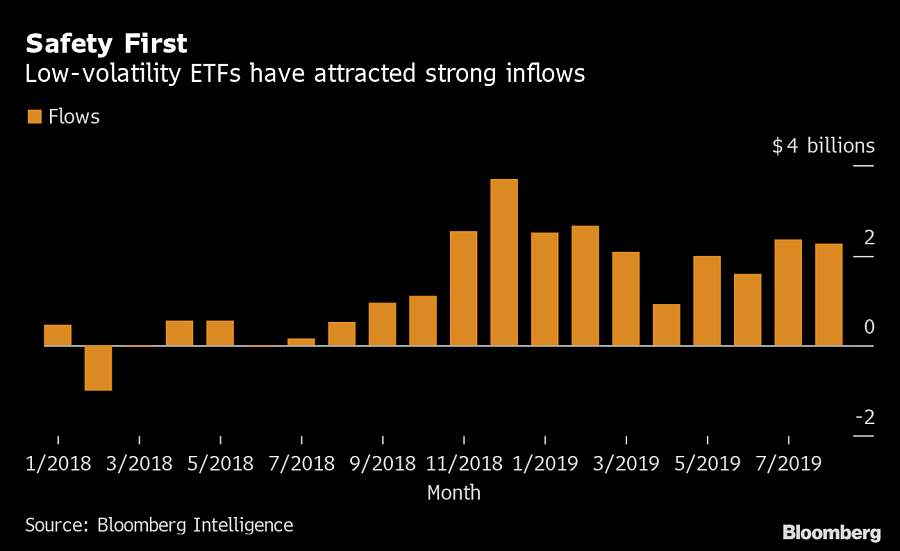

While a clutch of protective trades are looking dangerous, Barbaneagra still likes minimum volatility but frets overcrowding in ETFs. Rising valuations of the cohort — which includes bond proxies — make sense given the plunge in interest rates, he said.

U.S.-listed exchange-traded funds tracking steady stocks have amassed more than $16 billion this year.

All told, Mr. Barbaneagra is not alone in fretting about extremes in factor performance. Just this week, Evercore ISI strategists led by Dennis DeBusschere noted that the spread between price momentum and value has widened to the highest level this year.

“The sharp increase suggests some reversion for risk-off factors if trade tensions continue to ease and macro data continues to beat expectations,” they wrote in a note.

(More: Countdown to catastrophe? A recession signal and the stock market)