Retirees face a variety of risks: bear markets, inflation, uncertain lifespan and declining health and the associated costs. Among these, health and health-care costs are the top concern for the majority of retirees, according to a recent T. Rowe Price study of retirement savings and spending.

This should not come as a surprise, given that some of the industry’s leading experts are projecting very high health-care costs in retirement.

(More: Why healthy clients need to save more for retirement)

Advertisement

The Employee Benefit Research Institute estimates a 65-year-old couple will need to budget approximately $301,000 to have a 90% chance of covering all their health insurance premiums and out-of-pocket costs, excluding long-term care, in retirement. Other estimates provide a similar picture.

While these numbers have some informational value, they aren’t helpful for financial planning because:

• The cost of health care in retirement isn’t a lump-sum bill, but one that is paid over 20 to 30 years. We might balk at an $86,000 cable bill in retirement, but that’s what a $150 monthly cable bill adjusted for inflation adds up to over 30 years (assuming 3% annual inflation).

• It’s difficult to fathom the relative magnitude of health-care costs when they’re measured in current dollars, but not in terms of assets and future stream of income. For example, a 65-year-old couple with $400,000 in retirement savings and $2,000 in combined monthly Social Security income might panic if they think they will need $300,000 for health-care alone in retirement. Those expenses might seem more manageable if they knew that that their future Social Security benefits and asset income added up to about $1.3 million in current dollars. (With a 2% cost-of-living adjustment, the present discounted value of their Social Security benefits is about $583,000 over the next 20 years and a 4% nominal return produces another $320,000 in income.)

(More: How to effectively use health savings accounts for health care in retirement))

• Most estimates assume a single type of health insurance coverage, yet there are many options with different cost implications. According to the Kaiser Family Foundation, 30% of all traditional Medicare beneficiaries in 2016 had supplemental coverage through employer-sponsored insurance, 29% had supplemental Medigap coverage and 19% had no supplemental coverage at all. Also, one in three of all Medicare beneficiaries were enrolled in a Medicare Advantage plan in 2018.

So how should retirees estimate their health-care costs? We recommend considering:

1. The annual costs

2. The type of insurance coverage

3. Separating premiums and out-of-pocket costs

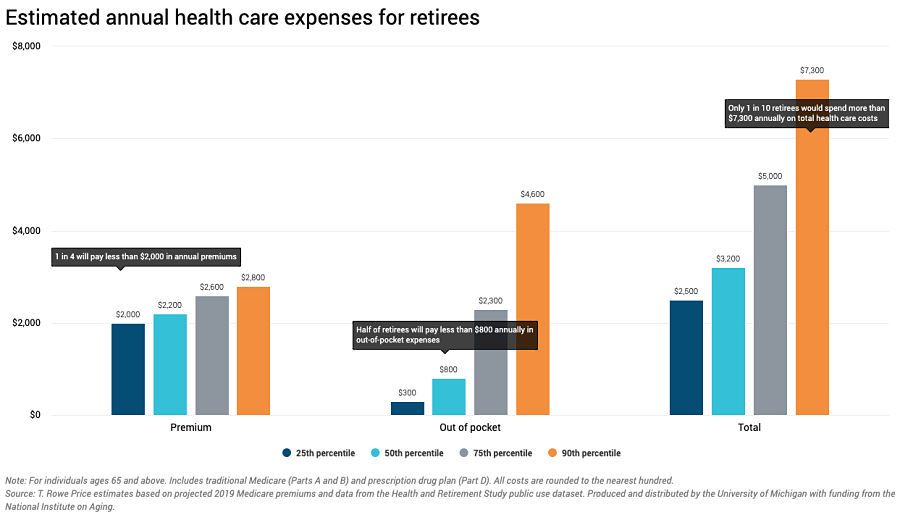

The chart above provides an example of how these costs look in retirement. In looking at this and other types of health insurance coverage, a couple of things stood out:

• In all cases, premiums account for nearly 75%-80% of annual health-care costs.

• Even though out-of-pocket costs are small on average, they can vary a lot.

How should retirees use this information?

• Premiums should be budgeted and paid for from monthly income because they are usually fixed and the annual premium changes are mostly predictable.

• Because out-of-pocket costs vary, they should be paid from relatively liquid assets, like a savings account.

Don’t fixate on one large number when it comes to health-care costs. To a large extent, they can be planned for and managed.

Sudipto Banerjee is a senior manager of thought leadership at T. Rowe Price.