Stocks are plunging and bonds are surging as investors flee to the safest assets amid growing speculation that the economic fallout from the coronavirus will be severe.

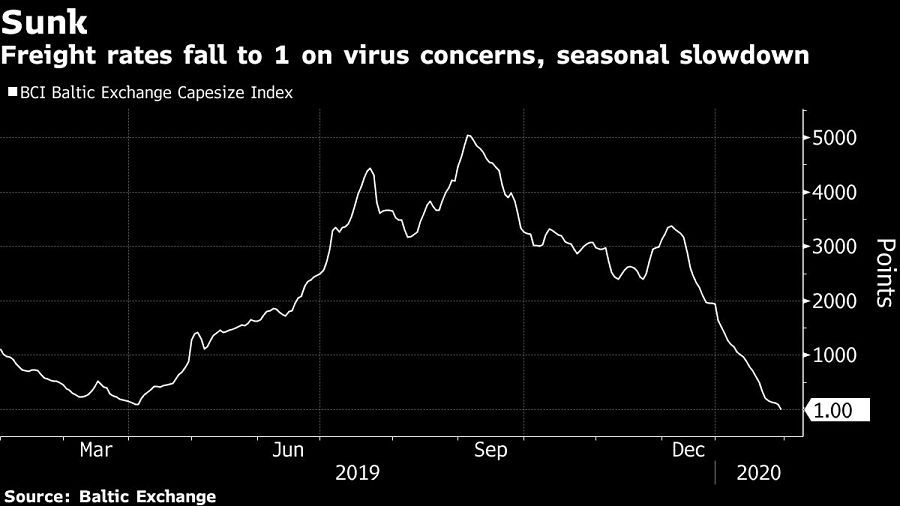

With global equity markets flashing red almost across the board, investors are homing in on indicators in other assets classes to watch for signs of panic. In commodities, it’s copper that’s taken the brunt of selling as China’s economy buckles. Shipping rates, closely watched as a harbinger of a slowdown, are back in vogue. Below are charts of other assets reacting most to the risk-off mood.

The Baltic Exchange Capsize Index, a gauge of freight rates for dry-bulk cargoes, is down 99.95% this month as the virus accentuates a seasonally slow period. That’s not to say rates are near zero. Rather the index measures demand for shipping versus availability of ships and it is now showing a huge imbalance.

Advertisement

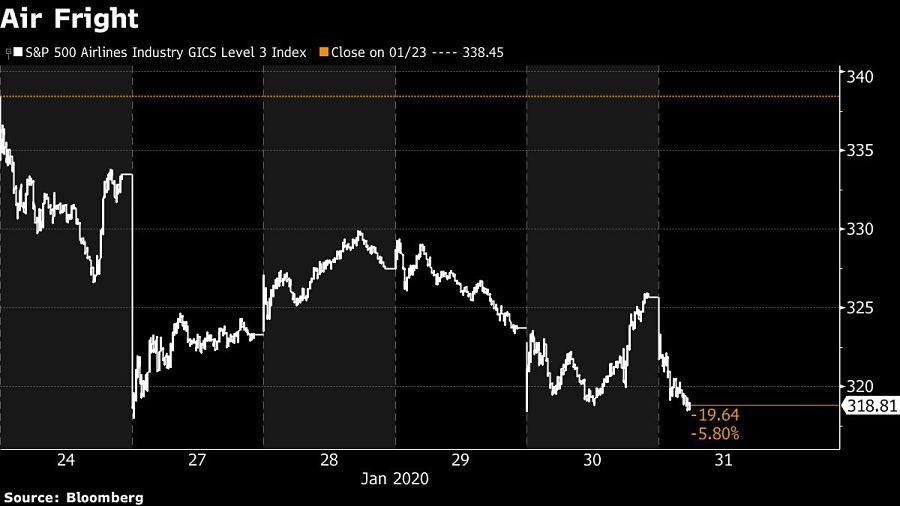

Companies that ship via the air aren’t doing much better, with air freight and logistics the worst-performing sub-industry in the S&P 500 this week.

While the World Health Organization stopped short of recommending a ban on travel and tourism, passenger airlines received only a brief respite. Many have since taken measures into their own hands, with Delta Air Lines on Friday announcing a suspension of all U.S.-China flights from Feb. 6 through April 30. Other airlines previously announced plans to reduce service.

With China’s economy virtually shut down, and only about one-third of it likely to come online Monday, demand for commodities from the world’s biggest user is dropping precipitously. Copper futures have fared worst among the most liquid commodities, with the metal on a record 13-day losing streak, half of which predates virus fears.

Shares of mining giant Freeport-McMoRan Inc. have similarly swooned. Stress in the commodity complex is also evident in junk energy bonds, with spreads widening more than 100 basis points since mid-January.

But U.S. Treasury bonds are in high demand amid the market tumult, with both real rates and break-evens contributing meaningfully to the more than 35-basis-point monthly decline in the 10-year rate. The 30-year slumped below 2% for the first time since October, and the yield on December 2020 Eurodollar futures (a proxy for the amount of tightening or easing traders expect from the Federal Reserve), implies nearly a full 25-basis-point cut has been priced in relative to the start of 2020.

The Brazilian real weakened to a record low of 4.2779 per dollar Friday as traders dumped emerging-market assets amid growth fears. Economists expect the central bank to deliver a 25-basis-point cut next week.

The Chilean peso is also tumbling, approaching levels that prompted central bank intervention in November. Roughly one-third of Chile’s exports go to China.

U.S. stocks sank Friday, but selling has been much worse the closer you get to China. Though markets are closed there for the Lunar New Year holiday (and the virus), Chinese equity futures traded on the Singapore Exchange are down over 8% this week. Asian and emerging-market indexes are trailing the S&P 500 by a substantial margin.

Segments within the equity market coming under acute stress include casino operators with exposure to Macau, luxury goods sellers, and cruise liners.