Wall Street’s best minds are falling over themselves to describe the cataclysms that would befall equities should Elizabeth Warren get elected. It’s a brand of analysis whose recent track record is abysmal.

The S&P 500 will plunge 25% if the Democrat becomes president, says Paul Tudor Jones, the hedge fund manager. Discovery Capital Management founder Rob Citrone says she’s “the single biggest risk for the market” and calculates the downside at up to 20%. Billionaire Leon Cooperman told CNBC earlier this month that the market would drop 25% if Ms. Warren or Bernie Sanders were to win.

That’s a lot of certainty to attach to predictions Wall Street has shown no ability to get right in the past. The confidence sounds particularly rich considering what investors said about the man Ms. Warren aims to dethrone, Donald J. Trump.

Advertisement

“Strategists predicting the impact of a presidential election are worse than the pollsters,” Matt Maley, equity strategist at Miller Tabak + Co., said by phone. “It’s one of the best contrary indicators out there.”

Sure, the forecasts could come true. Maybe Ms. Warren’s plans to rein in Wall Street and corporate America will kill the economy, or maybe the bull market will just die of old age. But there’s scant evidence that a president’s political leanings do much to sway stocks

Variations in equity performance when a Democrat is in the White House are almost negligible when compared with Republicans, according to research from Vanguard that was published before the 2016 election.

Everyone knows stocks soared under Mr. Trump. Everyone did not know that would happen before he won. Heading into November 2016, strategists and economists focused on his unpredictability, his protectionist ideas, instead of pro-growth policies like tax cuts. Many predicted a more volatile Mr. Trump would send stocks into a correction.

Strategists at RBC Capital Markets said prior to Election Day that a Trump victory would send the S&P 500 down 10% to 12%. Barclays had predicted a drop of as much as 13%. The team at JPMorgan advised investors to sell the rebound that materialized just a few hours after Trump won.

It wasn’t just stock handicappers. Two economics professors, Justin Wolfers and Eric Zitzewitz, wrote a paper on the topic for Brookings in October 2016. They analyzed the futures market during the first presidential debate and extrapolated the reaction to conclude a Trump win would send stocks down 10% to 15%. A Massachusetts Institute of Technology economist posited that a Trump presidency would cause a stock market crash and could plunge the global economy into recession.

Partly, it was a reflection of polling data. Since Mr. Trump was viewed as a long shot, many predicted investors would be shocked into selling if he won. That was the thinking at Citigroup, where strategists said the S&P 500 could lose 3% to 5% immediately. They added that a Trump win would also pose risks to stocks in the long term.

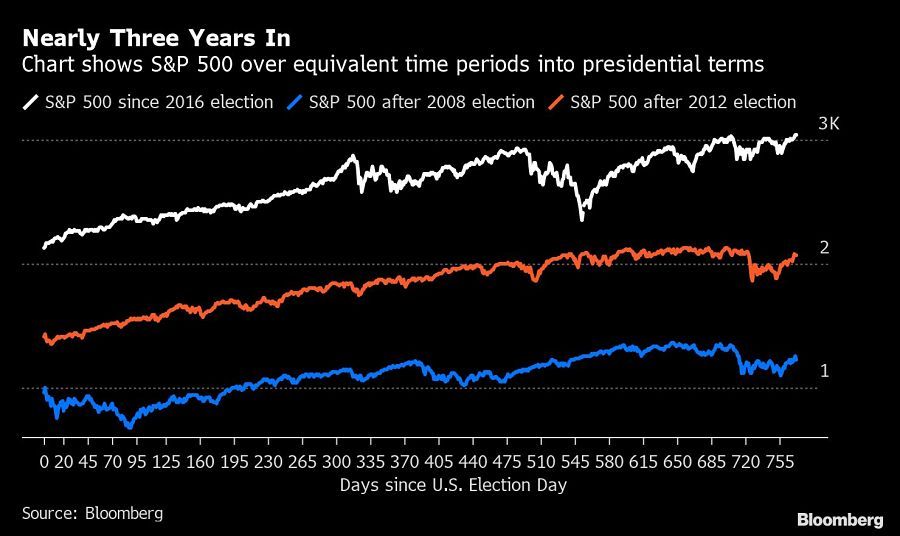

The first prediction came true. S&P 500 futures were halted after a 5% plunge in the hours after the 2016 race was called. But they rebounded just as fast and the index has gained more than 40% since Trump’s election.

[More: Measuring the ‘Trump rally’ against past presidents]

It was much the same for Barack Obama as he ran for reelection against Mitt Romney in 2012. Two months ahead of the election, nearly 50% of respondents in a Bloomberg survey said a win for the incumbent would be a negative for U.S. financial markets. That’s even after the S&P gained 42% from Obama’s first election to his second.

Among prognosticators who muffed the call was Donald Trump, who said in a November 2012 tweet that both the stock market and the U.S. dollar would plunge following Mr. Obama’s second victory. The S&P 500 rose almost 50% in that term, bringing Mr. Obama’s eight-year return to 112%, while Bloomberg’s dollar index gained 21% in the four years that ended in November 2016.

In the heat of an election, people let their emotions take over and exaggerate the impact a president will have on the economy and markets, according to Mark Hackett, chief of investment research at Nationwide Funds Group.

“The most naysaying people to Barack Obama will admit that there was not a transformation of our economy in any way that they would’ve feared the day he got elected. Same thing with the Democrats with Trump. There hasn’t been this transformation that was feared,” Mr. Hackett said. “Our economy is bigger than one person or one election cycle.”

Another forecasting entity that often miscalculates is the stock market itself. Shares plunged more than 5% the day after Mr. Obama was elected to his first term and the loss in the S&P 500 swelled past 3% the second time. Neither proved prescient.

Even as the evidence points to how difficult it is to nail the predictions, the prognostications are likely to continue streaming in — and anxiety is likely to spiral heading toward Nov. 3, 2020, as the battle for the presidency heats up.

“Political risks are obviously still out there,” said Jennifer Foster, co-chief investment officer of equities at Chilton Trust. However, the election is “still a year away — there’s still a lot of time for things to happen. Trying to take those risks and assign them to equity valuations today just feels like an exercise in futility.”

[More: Trump impeachment threat is mission impossible for Wall Street]