Investors in U.S. growth stocks have been richly rewarded in recent years, but their fortunes are set to turn if President Donald J. Trump can’t resolve his trade disputes.

Bloomberg News reported Wednesday that China and the U.S. had wrapped up three days of trade talks and “expressed optimism that progress had been made.” For Mr. Trump, that’s a clear departure from his usual tough talk on trade.

That shouldn’t be surprising. As I pointed out recently, the president fancies himself a champion of American business and gauges his success by the level of the stock market. The market’s steep drop in December signaled that the country’s biggest companies, which dominate market barometers such as the Dow Jones Industrial Average and the S&P 500 Index, are under increasing stress. They generate much of their revenue overseas, so Mr. Trump’s trade disputes are an obvious concern.

Advertisement

If the president was hesitant to connect those dots, Kevin Hassett, chairman of the White House Council of Economic Advisers, was not. He told CNN last week that “There are a heck of a lot of U.S. companies that have sales in China that are going to be watching their earnings being downgraded next year until we get a deal with China.” That was a day after Apple cut its revenue outlook, blaming in part weaker demand in China.

But Mr. Trump’s trade policies don’t affect all companies equally. Growth companies, or those that are expected to grow faster than average, sell more of their products overseas than slower-growth value companies. That means growth companies have more to gain from free trade and, of course, more to lose during a trade war.

Consider that, on a weighted average basis, companies in the S&P 500 Growth Index generated 58% of their revenue from foreign sources, according to numbers compiled by Bloomberg based on the most recent financial statements. That compares with 48% for companies in the S&P 500 Value Index.

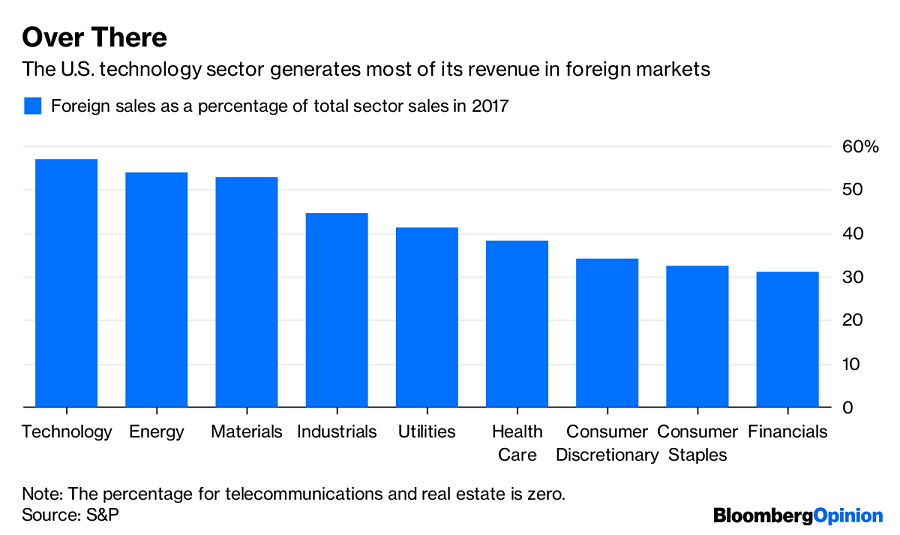

A big part of that difference can be attributed to technology companies such as Apple. According to the most recent S&P 500 global sales report, technology companies generated 57% of their sales outside the U.S. in 2017, more than any other sector. And technology stocks tend to be growthy. They account for 25% of the growth index, compared with just 15% of the value index.

The market has been gently signaling the danger to growth stocks. The S&P 500 is up 9.9% since Christmas, when Mr. Trump sought to reassure the market by telling reporters he has confidence in the Federal Reserve and the U.S. economy and then made conciliatory overtures to China. Tellingly, growth stocks have benefited the most. The growth index has outpaced the value index by 1.2 percentage points through Wednesday.

And that’s not the first sign that trade is a big deal for growth stocks. During the recent market swoon, growth stocks bore the brunt of trade and other concerns. The growth index was down 1.4 percentage points more than the value index from the market’s recent peak on Sept. 20 to its trough on Christmas.

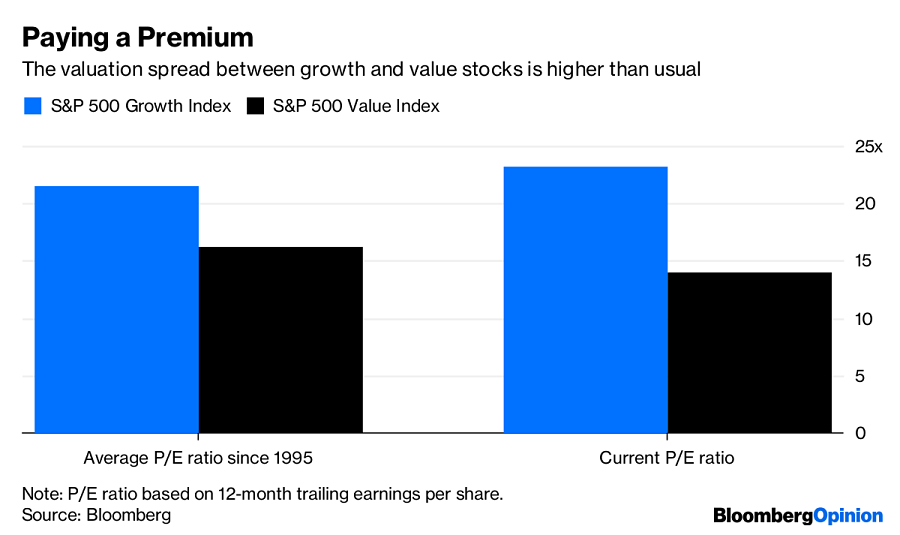

This is a particularly risky time for growth stocks because they have more room to fall than usual. The growth index has outpaced value by 4.5 percentage points a year over the last decade through 2018, which has stretched the valuations of growth stocks relative to value. The growth index’s price-to-earnings ratio has averaged 21 since 1995, based on 12-month trailing earnings per share, compared with 16 for the value index. Those numbers are now 23 and 14, respectively.

A bull market doesn’t die of old age; something comes along and kills it. The market is telling investors that if Trump can’t resolve his trade disputes, the bull market for growth stocks is likely to be among the casualties.

(More: Fidelity’s zero-fee funds unleash the power of free)

Nir Kaissar is a Bloomberg Opinion columnist covering the markets.

This is a particularly risky time for growth stocks because they have more room to fall than usual. The growth index has outpaced value by 4.5 percentage points a year over the last decade through 2018, which has stretched the valuations of growth stocks relative to value. The growth index’s price-to-earnings ratio has averaged 21 since 1995, based on 12-month trailing earnings per share, compared with 16 for the value index. Those numbers are now 23 and 14, respectively.

A bull market doesn’t die of old age; something comes along and kills it. The market is telling investors that if Trump can’t resolve his trade disputes, the bull market for growth stocks is likely to be among the casualties.

(More: Fidelity’s zero-fee funds unleash the power of free)

Nir Kaissar is a Bloomberg Opinion columnist covering the markets