The Federal Reserve will likely cut interest rates this year but not nearly as aggressively as investors expect, according to a Bloomberg survey of economists.

Respondents to a June 7-12 poll saw policymakers lowering rates by a quarter point this year.

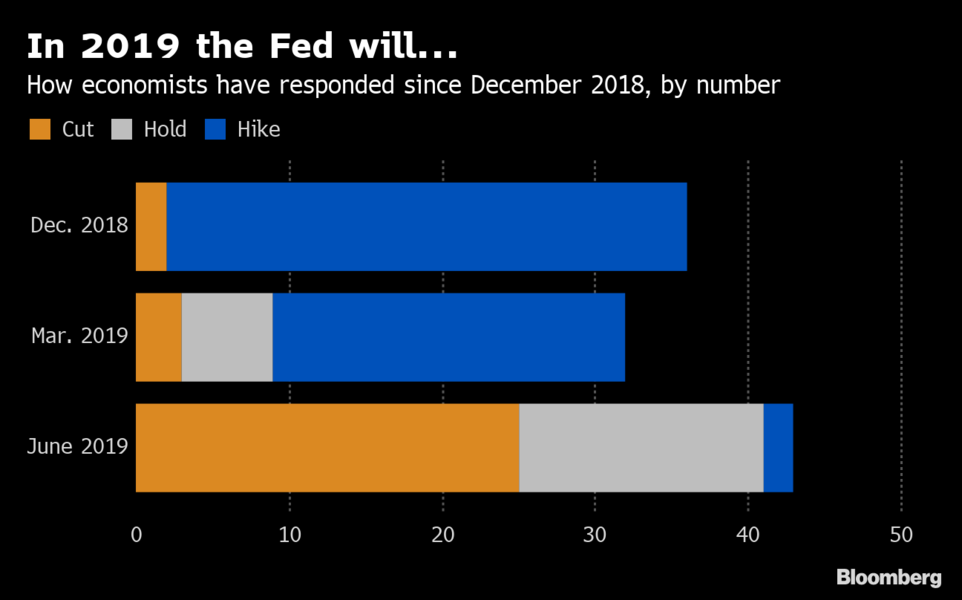

That’s a meaningful shift since March — when economists anticipated a hike in September — reflecting a darkening global economic outlook driven in part by President Donald J. Trump’s escalating dispute with major U.S. trading partners.

Still, economists believe the Fed won’t rush into a rate cut. None of the 43 respondents expect policymakers to act when they meet next week in Washington. The median survey response pointed to a quarter-point reduction in December. Sixteen respondents expect the Fed to keep rates steady all year and two anticipate a quarter-point hike.

Advertisement

Investors, by contrast, are pricing in 70 basis points of easing by the end of 2019, based on federal funds futures contracts.

“The Fed will signal it stands ready to cut rates if downside risks materialize, but it does not want to preemptively lower rates before seeing evidence of much slower growth in the economic data,” said Kathleen Bostjancic, an economist at Oxford Economics.

Data released on Friday showed U.S. retail sales posted a broad-based gain in May, and the prior two months of sales data were revised higher, suggesting support for the economy from healthy consumer spending that may ease near-term pressure for a move.

Fed officials gather next Tuesday and Wednesday in Washington. Economists and investors alike will be on the lookout for any signal that policy makers intend to cut at their next meeting, in July.

The Fed is scheduled to release a policy statement at 2 p.m. Wednesday, followed 30 minutes later by a press conference with chairman Jerome Powell.

In the survey, nearly three-quarters of respondents predicted the Fed will drop a reference to being “patient” from their post-meeting statement, replacing it with language similar to recent comments made by Mr. Powell about “closely monitoring” developments and promising to “act as appropriate” to sustain the economic expansion. About half also anticipated the statement will make a specific reference to trade negotiations.

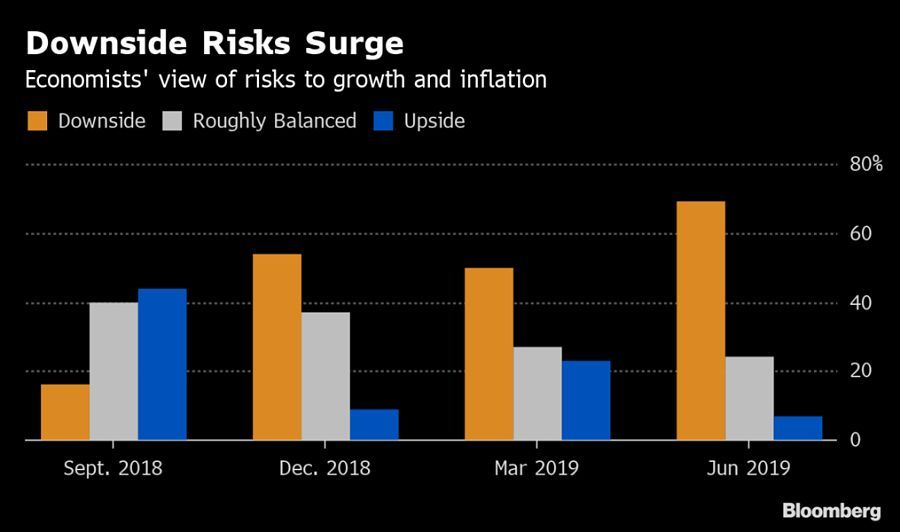

Reinforcing the shift in sentiment, more than two-thirds said risks to growth and inflation are tilted primarily to the downside, up from 50% in March and from 4% a year ago.

The chief source of that concern moved decisively from the more general “slowing global growth” to the specific “international trade disputes.” More than 60% of respondents listed the latter as the most serious threat to U.S. economic growth in 2019.

Ryan Sweet, head of monetary policy research at Moody’s Analytics Inc., said he doesn’t expect a cut this year unless the trade landscape worsens.

“The assumption in our baseline is that an agreement is made” with China, he wrote. “If a deal isn’t struck or Trump escalates the tensions by imposing tariffs on the remaining $300 billion in Chinese imports after the G-20 meeting, then we will likely alter the forecast to include the Fed cutting rates this year, possibly in July.”

The president will attend the G-20 meeting in Osaka, Japan on June 28-29.

Differing views over how to factor in trade-related risks may explain much of the gap between investors and economists over rate forecasts, according to Samuel Rines, chief economist at Avalon Advisors.

“In determining future fed funds changes, it is necessary to handicap trade negotiations and that injects a significant amount of uncertainty in the outlook for rates,” Mr. Rines said. “Markets appear to be saying it is better to assume the worst-case scenario than be caught off guard.”

Responding to a new question, economists were almost evenly split on whether the Fed will seek to bolster its control of overnight interest rates by introducing a standing repurchase facility. If the Fed does move ahead with such a program, it’s most likely to be rolled out in the fourth quarter of 2019, respondents said.

With the Fed’s ongoing monetary policy framework review well under way, economists appear to give more weight to the likelihood the central bank will adopt a new strategy for achieving price stability.

The proportion saying such a change was highly or somewhat likely rose to 60%, up from 37% in March. Average-inflation targeting was again the overwhelming response when economists were asked what new strategy the Fed would adopt if it made a change.

(More: Global yield curves blare alarms about economic outlook)