Amid rising political uproar against buybacks, corporate America is stepping up its shopping spree.

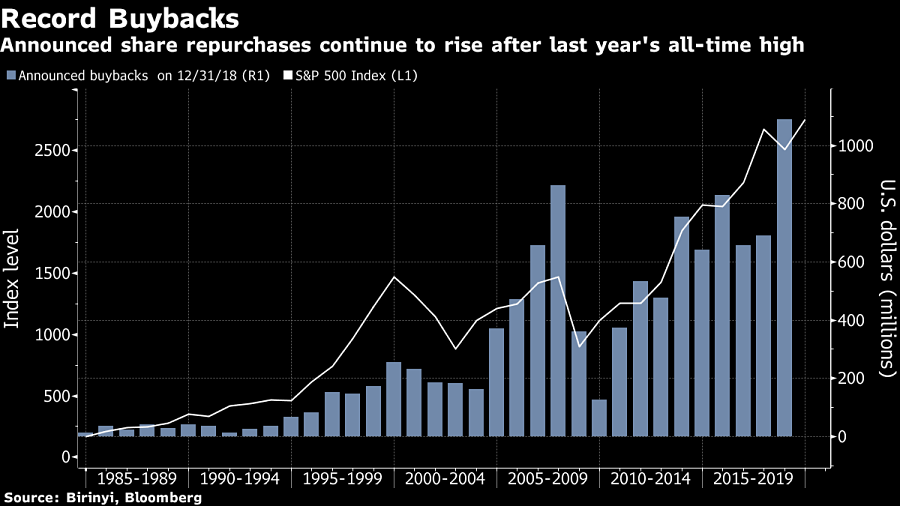

Six weeks into the year, U.S. companies have announced plans to repurchase $140 billion of their own stock, up 28% from a year ago, according to data compiled by Birinyi Associates Inc. While the pace trails the 58% increase for all of 2018, it’s more than double the average rate seen during the past five years.

Advertisement

Buybacks are picking up from a record pace after tax cuts boosted profits and cash piles grew. Last year, authorizations topped $1 trillion for the first time since Birinyi began tracking the data in 1984.

The buying spree is under growing attack as politicians are focusing on corporate governance as an election issue. On Tuesday, Senator Marco Rubio, R-Fla., announced a plan to tax buybacks on equal footing with dividends. Also this week, Senate Minority Leader Chuck Schumer, D-N.Y., and Sen. Bernie Sanders, I-Vt., said they’ll introduce legislation barring companies from buying back their own stock unless they first increase workers’ pay and benefits.

“In many cases, growth in revenue has been hard to achieve, companies don’t have a need for additional productive capacity, so a sensible thing to do in that case is invest in the company itself,” Peter Jankovskis, co-chief investment officer at Oakbrook Investments, said by phone. “Unless there is a bill passed, it’s going to become law, I don’t expect companies to be changing their behavior.”

While the threat to buybacks is growing, investors don’t seem to be worried. They poured a record $221 million into the Invesco Buyback Achievers ETF (PKW) in one day this week. The fund absorbed more than $282 million worth of trades Tuesday, the most ever and 46 times the average daily turnover since the fund’s inception in 2006.

The ETF tracks a market-cap weighted portfolio of U.S. stocks of companies that repurchased at least 5% of their outstanding shares in the last 12 months.

(More: All eyes on stock buybacks)