As private bankers to the super-rich tailor their services to what they expected to be a new globally conscious generation, it turns out that wealthy millennials aren’t much more green or altruistic than their parents.

Advertisement

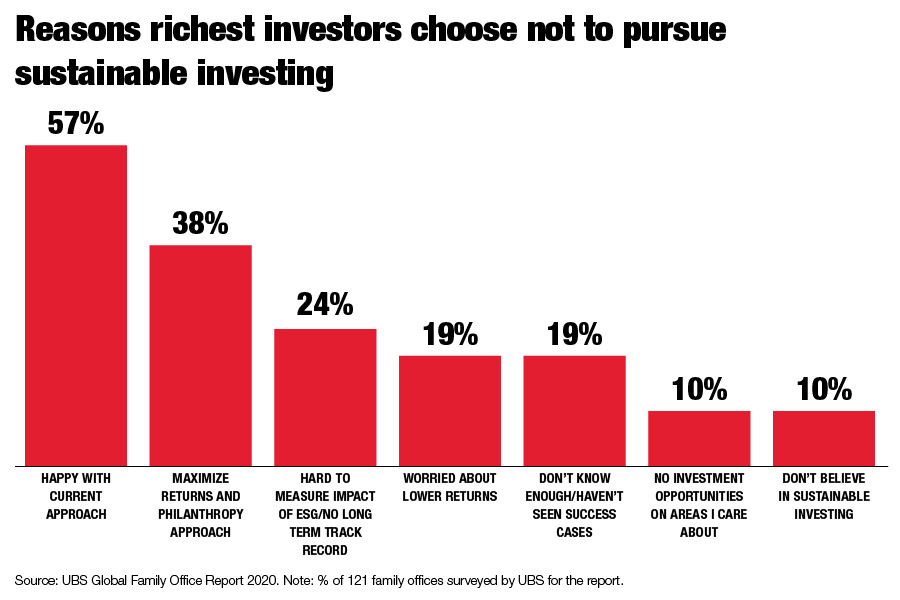

That’s the finding of UBS Group’s survey of 121 family offices, including some of the world’s wealthiest. The incoming heirs of dynasties prioritize financial returns over sustainable, do-good strategies just as much as the previous generation did, according to the survey. A majority prefer to keep investments just as they are.

“Unlike what you hear, a next generation that is meant to be very green and very altruistic and very much anti-business, is actually very pro-business,” Josef Stadler, head of the global family office unit at UBS, said in an interview.

Billionaires will pass on more than $2 trillion of wealth within the next two decades, according to research by UBS and PwC. The world’s top wealth managers have been bolstering their offerings of green, sustainable and good governance investments — known as ESG — as studies from as recently as last year indicated that they would be more attractive to millennials taking over.

“We have learned this is not the case,” said Isadora Pereira, a UBS director and one of the report’s authors. “They are interested and they are engaged in impact and sustainable investing, but I just don’t think it’s this black-and-white, water-to-wine change that has been discussed.”

More than half of the family offices surveyed are just as focused on maximizing financial returns as in the past. In Asia and the U.S., the proportion increases to almost three-quarters. Many rich families still see philanthropy rather than investing as the way to have an impact on ESG issues.

Private banks have raced to prepare for the transition of wealth management to serve a presumably greener new generation. Last year, Standard Chartered started training its private bankers to be experts in impact investing and Deutsche Bank’s wealth arm accelerated its ESG strategy by adding sustainability and ethics ratings to assets and more funds focused on the area. In 2017, UBS pledged to support its wealthy clients in investing $5 billion in impact investments and developed products and ways for those clients to invest sustainably.

[More: BlackRock engagement update since January ESG pledge]

Unlike pension funds and other institutions, family offices aren’t constrained by regulations to disclose environmental and social risks and don’t face the same investor pressure to de-carbonize investments or take a stand on climate change through their asset allocation.

Those family offices that do incorporate sustainability into their investing strategies mostly do so by excluding companies or sectors, rather than investing deliberately in a project that could have a positive ESG-related impact. More than half the family offices surveyed said they see evaluating performance of those projects as a challenge given the lack of common global standards and benchmarks.

“When it comes to impact investing, family offices put competitive rates of investment return first, placing environmental or social impact objectives second,” UBS wrote. While many rich families view sustainable investing as important for their legacies, it’s unclear whether good intentions will turn into reality, it concluded.

[More: Heirs of ultra-wealthy can profit when markets plunge]